Family Office Investment Management

The most important financial tools for managing complex wealth in a single place. Family Office Association does not participate in the offer sale or distribution of any securities nor does it provide any investment advice.

Why Are Family Offices On The Rise Ocorian

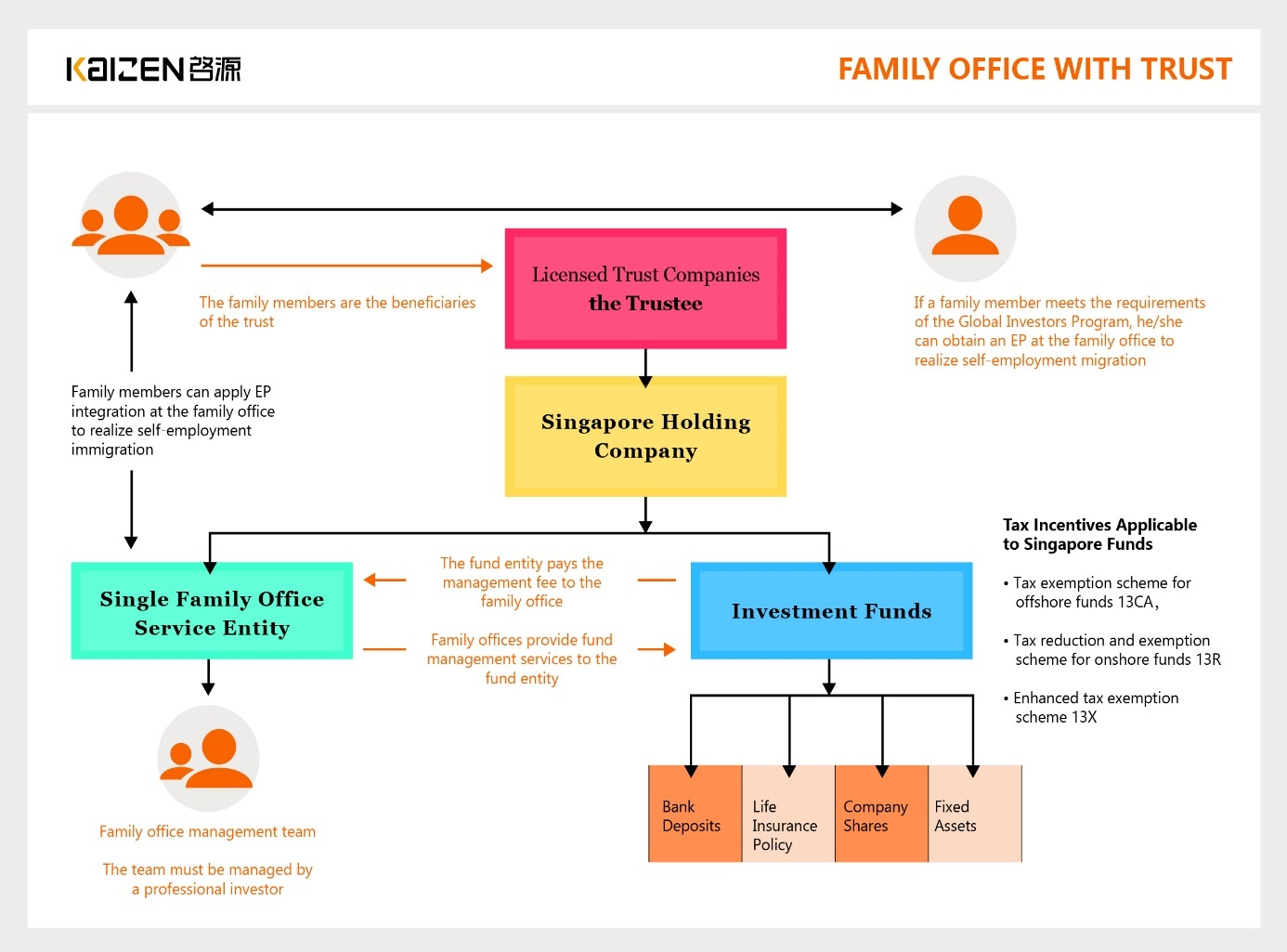

Singapore Family Office Concept Structure Tax Incentives Exemptions Residency

The Family Office Concept Family Office Management Consulting Ltd

Our mission is to work together for a better tomorrow.

Family office investment management. A windfall due to the sale of business or inheritance of financial real assets which needs professional management A corpus has been built over a period of time through normal saving ESOPs sale of a. Family offices are private wealth management advisory firms that serve. Our firm was founded to help successful families seize the opportunities of wealth and avoid the pitfalls.

A family requires professional management of their financial assets. Prior to this Mr. Northwood Family Office ranked top North American Family Office with.

For more details contact us today. The Family Office is an independent wealth management firm serving some of the wealthiest families individuals and investors in the GCC. The client agreed on a 500m cash management investment based on their risk profile and preferences.

Northwood Family Office Ranks 1 for Family Office Services in Canada and North America in the 2021 Euromoney Private Banking and Wealth Management Survey Press Release Read the Press Release. Foundation Holdings leverages its managements extensive track record in operational value creation and IPOs in the robust healthcare and education sectors. Every family office is as unique as the family it serves.

Family offices can provide a wide range of services including. Our Family Office Investment Summit is the foremost Global Platform Gathering of Elite Family Offices and High-Profile Private Investors. Meeting in person exchanging rich thought leadership ensuring safe investing legacy building and making the world a better place is a conscious power families possess.

The loyalty and dedication of our people to Notre Dames mission leads us to steward the Universitys assets as family money and treat every interaction and. A UAE based family office. Matter is a true family office.

A family office that does not meet the exclusion terms set forth in the rule but has been providing investment advice primarily to members of a single family since a date prior to July 22 2011 and is not registered under the Advisers Act in reliance on the private adviser exemption on July 20 2011 must register as an adviser or obtain an exemptive order from the Commission by March 30 2012. At Ulrich Investment Consultants we offer superior investment advice valuable insights and a broad range of Wealth Management and Investment consulting services. We preserve and grow wealth outside the typical private banking model through exclusive private investment opportunities in alternative asset.

Raffles Family Office RFO is an award-winning commercial multi-family office with a full suite of investment management services for ultra-high net worth individuals. Further Family Office Association does not. Our Family Office is Canadas first truly integrated multi-family office where affluent families protect and grow their wealth while preserving their legacy for the future.

Local jurisdictional restrictions could apply. A comprehensive cash management proposal with solutions from Investment Bank and Wealth Management was presented to corporate treasury. A family office is a privately held company that handles investment management and wealth management for a wealthy family generally one with over 100 million in investable assets with the goal being to effectively grow and transfer wealth across generations.

We provide customized investment management wealth advisory and general financial oversight by developing a clear picture of your values and vision for the future. Global Family Office Report 2020 This is the first of our annual in-house UBS reports on the activity of family offices. Transaction completed in October 2021.

Come and join Opal Financial Groups Annual Family Office Private Wealth Management Forum - WestKnown for the fastest growing population of newly structured family offices in the world Northern California is largely dominated by first and second-generation families from the Silicon Valley. SUMMITS HELD regions SPEAKERS Family. Crewe understands that high-net-worth families have specific needs to optimize their balance sheet support a strong legacy and reach family goals.

Khan was the Senior Advisor to the Governor of the Saudi Arabian General Investment Authority and managed corporate communications. Corecam is the family office arm of Corecam Investment Group. Pang served as the Managing Director at UBS Hong Kong from 2011 to 2015 heading up the banks ultra-high-net.

Shifting sands are Family Offices refocusing their Investment approach There are three trends reshaping the Family Office landscape. Our report focuses on 121 of the worlds largest single family offices covering a total net worth of USD 1424bn with the individual families net worth averaging USD 16bn. Since its creation in 2009 Corecam grew to become a leading investor with global perspectives across liquid asset classes as well as direct investments in real assets.

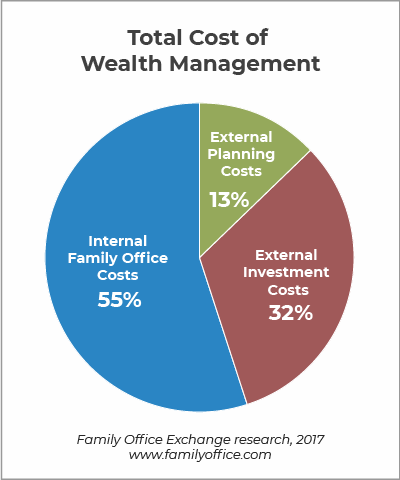

The companys financial capital is the familys own wealthFamily offices also may handle tasks such as managing household staff. Family Office Exchange FOX was the first and continues to be the industry-leading membership organization that brings together families family office executives and trusted advisors to build a community focused on peer exchange continuous learning and objective guidance. Wealth management is an investment advisory service that combines other.

Investment strategy and management. We lead the way on a purpose-driven path that supports your goals and values through our innovative family office services including investment management wealth planning and coordination and family culture and legacy. Families may create a family office to support their overall financial needs after the sale of a family business or another significant liquidity event.

Family Office clients have access to Crewe Advisors wealth management as well as Crewe Capitals investment banking and asset management capabilities. Find out why SEI Family Office Services and the award-winning Archway Platform have been trusted to handle the accounting investment data aggregation and financial reporting operations of family offices and financial institutions for 20 years. I have often hear Jedis in the Star Wars franchise refer to feeling a shift in the force well I have felt a deep shift in the thinking and behaviours of Family Offices.

Established in 2015 Fountainhead is a multi-family office primarily focuses on investment management for ultra-high-net-worth families. 6-7 November 2022 Mandarin Oriental Jumeira Dubai Now in its Ninth edition the Middle East Family Office Investment Summit is a firm fixture in the calendar of the most prominent and influential families in the region as well as those who want to do business with them. The family office can also handle.

We specialize in globally diversified capital preservation strategies.

The Family Office Quick Guide Family Office Exchange

Setting Up A Family Office In Singapore Bayfront Law

Successful Family And Wealth Management

![]()

Family Office Advisory Wealth Management Ubp

The Modern Family Office A New Kind Of Investor That S Here To Stay

Setting Up A Single Family Office In Singapore Singapore Company Kaizen

Family Office Advisor Skills Map The Institute Of Banking And Finance

Family Offices In Singapore Advanced American Tax